Salon Profit and Loss Statement

Confused by all the financial statements and tax laws to keep your small salon business running? What’s a P & L statement? The profit and loss statement is one of the most important financial documents of small business accounting. It includes the money we make (revenue), how much money we spend (expenses), and what our net income or profit is.

For a small hair salon, the profit and loss statement is very simple. Most hairdressers and barbers start out tracking their revenue and expenses manually in a notebook, next they advance to an Excel spreadsheet and finally they find Salon Accounting to help them track their finances.

Revenue

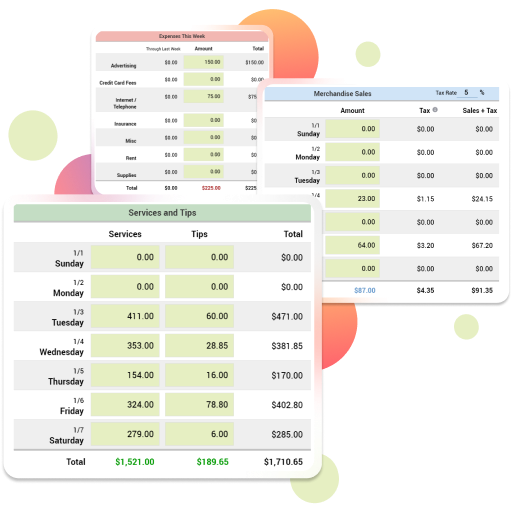

Your business’ revenue is made of up your services, tips, and merchandise sales. This is simply how much money you are receiving from customers. Salon Accounting is setup to view your business financials in a weekly view, so you’ll simply input your services, tips, and sales for each day in the week.

Expenses

The costs of running a salon can add up quickly. Here are the typical salon expenses: Rent, Utilities (like electricity, water, gas), Equipment and Supplies (like shampoo, perms, umbrellas), Insurances, and Licenses. Visit the article, “Average Salon Startup Expenses and Ongoing Expenses” for a full list of applicable expenses that you might incur as your business is getting started and after it has been operational for a while.

**Salon Accounting can securely connect to your bank and automatically import expenses from your credit card!

Net Income (profit)

The Net Income is the difference of your Revenue minus your Expenses. As soon as you make changes in Salon Accounting books, your revenues, expenses and profits are automatically recalculated! If you are a solo small business, the net income is yours but you still need to pay tax on that amount. Salon Accounting can also help you prepare your quarterly tax amounts so you stay clear of potential tax liabilities.

Prepare your Profit and Loss Reports

Profit and loss statements should be prepared at least on a weekly basis to find any discrepancies in income or expenses! Fortunately for Salon Accounting users, the screen will automatically calculate the totals for you so you just need to enter the revenue and expenses. Salon Accounting makes it quick to get into the app, save your revenue and expenses data, and get on with your life!

You can also navigate to the Reports page within Salon Accounting and create a specific Profit and Loss Report for any month, quarter, or specific date range you choose. Get started today with Salon Accounting and the free 14 day trial!

Photo by Sharon McCutcheon on Unsplash