View all Business Tips and Guides

How to Pay Quarterly Estimated Taxes

Sign up for Quarterly Taxes

Login to the app and navigate to the Taxes page from the top menu navigation and checkout for Quarterly Estimates Taxes.

- Understand and calculates your US quarterly federal tax requirements

- Access to update quarterly payments as your income fluctuates throughout the year

- Reminders throughout the year to send in your payment

- Pay accurately and on-time

Update your Tax Profile

Update your tax profile for the year, specify your married and filing status, number of dependents and other income. If you have another job, guesstimate how much you’ll make through the end of the year. This helps to project out your income through the end of the year to identify your tax brackets.

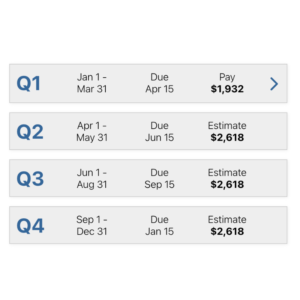

Pay Estimated Taxes on Time

We will send you an email to remind you when the quarterly estimates taxes are due, so you can jump back into the app and see the estimated tax amount you’ll need to pay.

Pay the IRS

- Open a web browser to www.irs.gov , click Pay in the top navigation, and then click Your Online Account

- Click Sign in to your Online Account , create a new account using secure ID.me. You’ll have to upload a photo of your ID and a selfie, it’s awkward but more secure than a username and password.

- When you’re logged in, click Make a Payment and then choose Estimated Tax , enter the amount estimated amount for the quarter from Salon Accounting.

- Enter your bank and account numbers which are located on the bottom of a check, the routing number is the first 9 digits followed by your account number.